Tax Table 2017 Malaysia

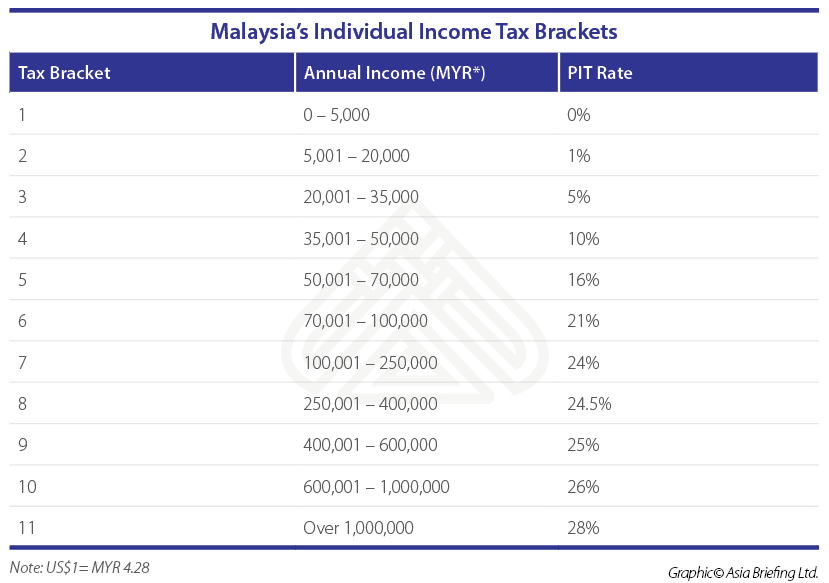

Technical or management service fees are only liable to tax if the services are rendered in malaysia while the 28 tax rate for non residents is a 3 increase from the previous year s 25.

Tax table 2017 malaysia. This guide is for assessment year 2017 please visit our updated income tax guide for assessment year 2019. Melayu malay 简体中文 chinese simplified malaysia personal income tax rate. With effect from ya 2020 a non resident individual is taxed at a flat rate of 30 on total taxable income.

Green technology educational services. 6 2017 date of publication. On 10 april 2017 the income tax exemption no.

Some items in bold for the above table deserve special mention. 2 order 2017 was gazetted to provide a special income tax exemption for companies limited liability partnerships trust bodies executors of estates and receivers under subsection 68 4 of the income tax act 1967 the act. A qualified knowledge worker in a specified area currently only iskandar malaysia is taxed at the concessionary rate of 15 on chargeable income from employment with a designated company engaged in a qualified activity e g.

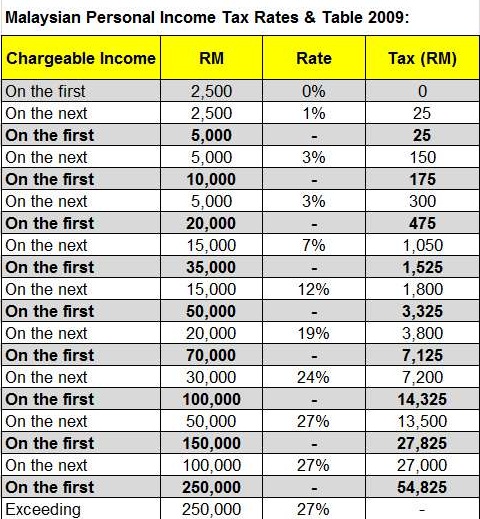

In malaysia for at least 182 days in a calendar year. On the first 2 500. No guide to income tax will be complete without a list of tax reliefs.

2017 malaysia budget speech tax highlights crowe horwath kuala lumpur. This page is also available in. Hasil care line 03 8911 1000 603 8911 1100 luar negara waktu operasi.

Pwc 2016 2017 malaysian tax booklet personal income tax tax residence status of individuals an individual is regarded as tax resident if he meets any of the following conditions i e. On the first 5 000 next 15 000. Inland revenue board of malaysia tax on income of a non resident public entertainer public ruling no.

Calculations rm rate tax rm 0 5 000. As the clock ticks for personal income tax deadline in malaysia 2018 like gainfully employed malaysians you may have started visiting the lhdn malaysia website to do your e filing as both a proactive and precautionary measure. 12 october 2017 director general s public ruling section 138a of the income tax act 1967 ita provides that the director general.